This is one of the most critical questions for stationery importers today. While a simple price-per-unit comparison might initially favor Vietnam, the Total Landed Cost—which includes materials, manufacturing, logistics, tariffs, and risk—reveals a more complex picture.

Here is a total cost comparison to guide your sourcing decision.

Executive Summary: The Core Trade-Off

- Vietnam can be cheaper for high-volume, labor-intensive, simpler goods where lower labor costs outweigh other factors.

- Yiwu is often more cost-effective for complex, custom, or mixed-material products and for buyers who value speed, flexibility, and a mature ecosystem.

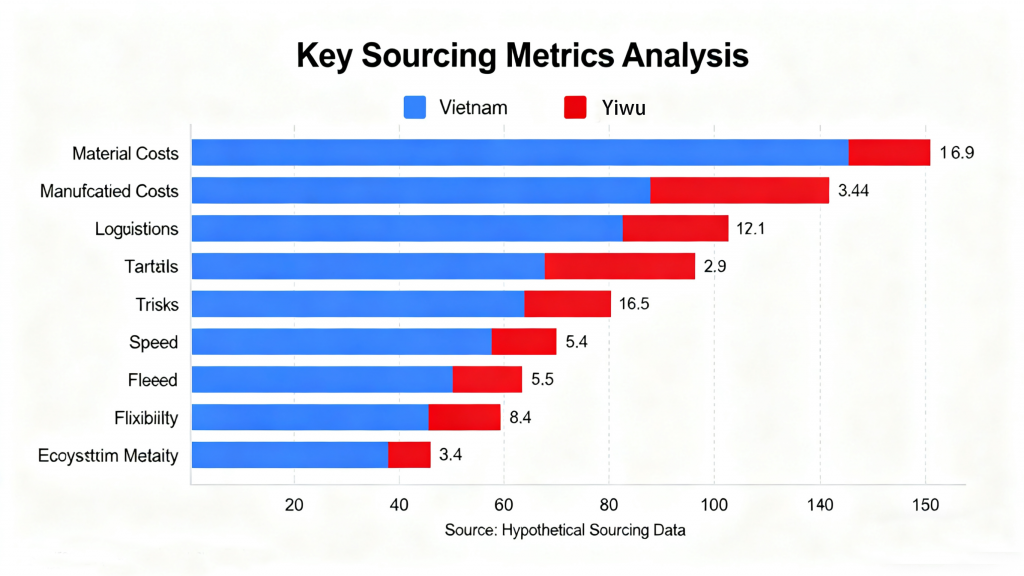

The following chart provides a visual overview of how key cost and efficiency factors compare between the two sourcing destinations:

The Detailed Breakdown: Yiwu vs. Vietnam

1. Direct Product Costs & MOQs

| Factor | Yiwu, China | Vietnam (HCMC/Danang Regions) |

|---|---|---|

| Unit Price | Highly competitive for most items. Economies of scale and hyper-specialization drive down costs. | Can be 5-15% lower for simple, labor-intensive items (e.g., basic plush toys, manual assembly). Can be higher for complex items. |

| Raw Material Access | Unmatched. A fully integrated supply chain for plastics, paper, ink, and metals within a few hours’ drive. | Often reliant on imported raw materials (e.g., specialty plastics, paper pulp) from China, adding cost and lead time. |

| MOQ Flexibility | Excellent. MOQs can be as low as 500-1,000 units for standard items, and flexible for custom orders. | Less Flexible. Factories often require larger MOQs to achieve cost parity, especially for custom goods. |

2. Labor & Operational Costs

| Factor | Yiwu, China | Vietnam (HCMC/Danang Regions) |

|---|---|---|

| Labor Cost | Rising steadily, but skilled labor is highly productive. | 20-30% lower base wage. A key advantage for manual assembly. |

| Worker Skill & Efficiency | Highly skilled in complex manufacturing and precision work (e.g., pen mechanisms, multi-material assembly). | Improving rapidly, but productivity can be lower. Less experience with highly complex stationery. |

| Factory Overhead | High competition among factories keeps margins tight. | Generally lower, but investment in modern machinery is still catching up. |

3. Logistics & Supply Chain Maturity

| Factor | Yiwu, China | Vietnam (HCMC/Danang Regions) |

|---|---|---|

| Supply Chain Ecosystem | Mature and Unbeatable. The “Yiwu Effect” means every component supplier, mold maker, and packaging vendor is within a dense network. | Developing. You may face delays sourcing a specific plastic clip or custom zipper, often needing to import from China. |

| Shipping & Logistics | Highly efficient, with frequent sailings and a wide range of freight options from nearby Ningbo/Shanghai ports. | Ports can be congested. Fewer direct sailings can lead to longer transit times and potentially higher freight costs. |

| Speed to Market | Faster. From order to shipment, lead times are often shorter due to supply chain integration and experience. | Slower. Longer production and shipping times can erode cost savings, especially for time-sensitive goods. |

4. Tariffs & Trade Agreements

| Factor | Yiwu, China | Vietnam (HCMC/Danang Regions) |

|---|---|---|

| US Tariffs | Subject to Section 301 tariffs (typically +25% for stationery). This is Yiwu’s biggest disadvantage for the US market. | A key advantage. Most stationery can be imported to the US duty-free, offering massive savings. |

| EU Tariffs | Generalized Scheme of Preferences (GSP) benefits have phased out, so standard duties apply. | Benefits from EU-Vietnam FTAs, offering reduced or zero tariffs for many goods. |

5. Hidden Costs & Risks

| Factor | Yiwu, China | Vietnam (HCMC/Danang Regions) |

|---|---|---|

| Communication & IP | Established practices for working with foreign buyers. Higher (but not zero) IP risk. | Language barriers can be more pronounced. IP protection frameworks are still developing. |

| Quality Control | Easier to find factories capable of high-quality, consistent output. | Quality can be inconsistent. Requires more rigorous and frequent on-the-ground inspection. |

| Sourcing Overhead | Lower. The path to finding and vetting suppliers is well-trodden. | Higher. Requires more time, travel, and effort to build a reliable supplier network. |

Decision Matrix: Which Should You Choose?

Source from Yiwu if:

- Your products are complex (e.g., mechanical pencils, electronics-integrated items, multi-part kits).

- You require high customization or rapid prototyping.

- Your order volumes are low to medium or you need a flexible MOQ.

- Your primary market is Asia, the Middle East, or Africa (where Chinese tariffs are less relevant).

- Speed-to-market is your critical priority.

Source from Vietnam if:

- Your products are labor-intensive and relatively simple (e.g., stuffed pencils cases, sewn fabric items, simple wood products).

- Your order volumes are consistently high.

- Your primary market is the US or EU, and avoiding tariffs is essential for your margin.

- You are strategically diversifying your supply chain away from China for risk management.

The Verdict

For most stationery buyers, Yiwu remains the default choice due to its unrivaled ecosystem, flexibility, and speed. The sheer efficiency and depth of the supply chain often compensate for higher labor costs and US tariffs.

However, Vietnam presents a compelling strategic alternative for businesses focused on the US/EU markets with simple, high-volume products, where its tariff advantage and lower labor costs can deliver a lower total landed cost.

The smartest strategy for many companies is not an “either/or” but a “both/and” approach, using each hub for its distinct strengths.

Navigate Your Sourcing Strategy with Confidence

Choosing the right sourcing base is a complex calculation. Penink Stationery provides data-driven insights and on-the-ground support in both Yiwu and Vietnam to help you optimize your total landed cost.

👉 Let’s Build Your Sourcing Plan:

- View Our Website: www.peninkstationery.com

- Strategic Sourcing Consultation: WhatsApp +86 139 5844 9443

We help you see the full picture, not just the price tag.